ترجمة وتحليل الكلمات عن طريق الذكاء الاصطناعي ChatGPT

في هذه الصفحة يمكنك الحصول على تحليل مفصل لكلمة أو عبارة باستخدام أفضل تقنيات الذكاء الاصطناعي المتوفرة اليوم:

- كيف يتم استخدام الكلمة في اللغة

- تردد الكلمة

- ما إذا كانت الكلمة تستخدم في كثير من الأحيان في اللغة المنطوقة أو المكتوبة

- خيارات الترجمة إلى الروسية أو الإسبانية، على التوالي

- أمثلة على استخدام الكلمة (عدة عبارات مع الترجمة)

- أصل الكلمة

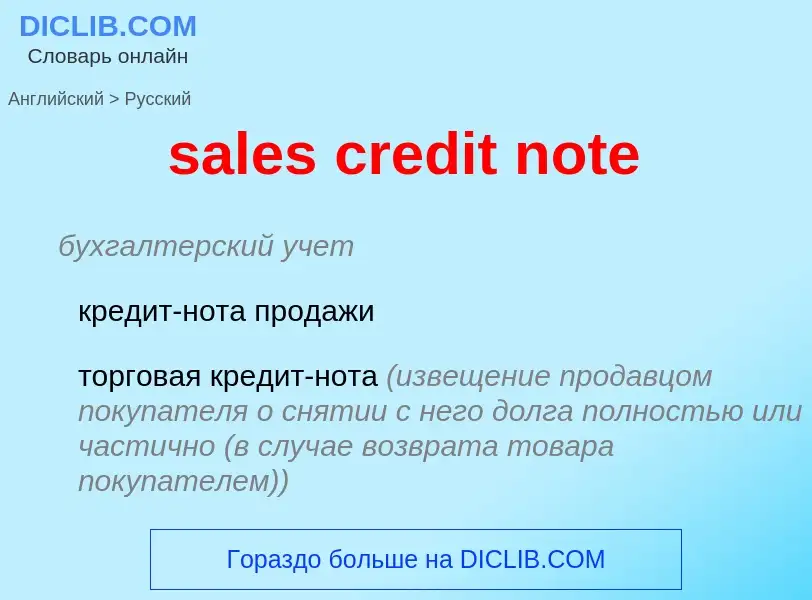

sales credit note - ترجمة إلى إنجليزي

бухгалтерский учет

кредит-нота продажи

торговая кредит-нота (извещение продавцом покупателя о снятии с него долга полностью или частично (в случае возврата товара покупателем))

Смотрите также

бухгалтерский учет

кредитовый меморандум

кредитовое уведомление

уведомление [меморандум] о кредитовании

(любой документ, в котором отправитель сообщает, что зачислил определенную сумму на счет получателя данного документа)

Смотрите также

['kreditnəut]

коммерция

кредитовое авизо (выдаётся покупателю, вернувшему покупку, на право приобретения другого товара на ту же сумму)

Смотрите также

تعريف

ويكيبيديا

A credit-linked note (CLN) is a form of funded credit derivative. It is structured as a security with an embedded credit default swap allowing the issuer to transfer a specific credit risk to credit investors. The issuer is not obligated to repay the debt if a specified event occurs. This eliminates a third-party insurance provider.

It is a structured note issued by a special purpose company or trust, designed to offer investors par value at maturity unless the referenced entity defaults. In the case of default, the investors receive a recovery rate.

The trust will also have entered into a default swap with a dealer. In case of default, the dealer will pay the trust par minus the recovery rate, in exchange for an annual fee which is passed on to the investors in the form of a higher yield on their note.

The purpose of the arrangement is to pass the risk of specific default onto investors willing to bear that risk in return for the higher yield it makes available. The CLNs themselves are typically backed by very highly rated collateral, such as U.S. Treasury securities.

The Italian dairy products giant, Parmalat, notoriously dressed up its books by creating a credit-linked note for itself, betting on its own credit worthiness.

In Hong Kong and Singapore, credit-linked notes have been marketed as "minibonds" and sold to individual investors. After Lehman Brothers, the major issuer of minibond in Hong Kong and Singapore, filed for bankruptcy in September 2008, many retail investors of minibonds claim that banks and brokers mis-sold minibonds as low-risk products. Many banks accepted minibonds as collateral for loans and credit facilities.